The cannabis industry has seen major changes in recent months, and that’s prompted many investors to take a look at marijuana stocks for the first time. In particular, key events like the beginning of recreational cannabis sales in Canada have given the businesses that grow, process, and distribute marijuana a chance to prove themselves. Unfortunately, that hasn’t gone as well as many had hoped, with numerous challenges preventing many companies from taking full advantage of the opportunity.

With that disappointment has come big share-price reversals, and that’s tempting many shareholders to give up on the sector. Yet even though there are legitimate concerns that cannabis companies need to address in order to be successful in the long run, marijuana stock investors need to understand that near-term share-price moves won’t always match up with the long-term prospects for the industry as a whole, or the specific companies that are currently assuming leadership roles in the industry’s growth.

IMAGE SOURCE: GETTY IMAGES.

A tough time for marijuana stocks

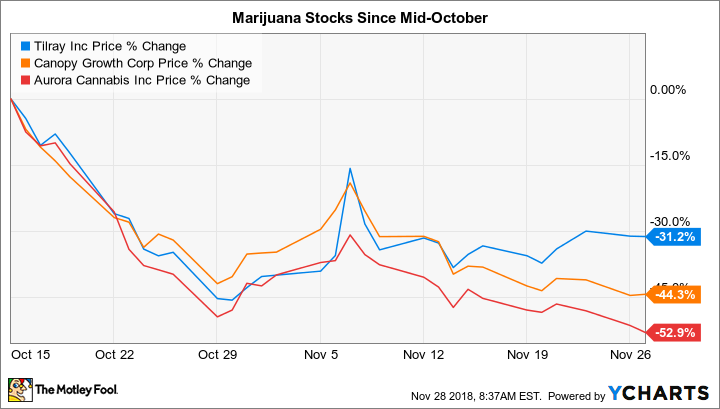

The past couple of months have been rough for most marijuana investors. Cannabis stocks with the largest market caps have largely seen their shares taken out to the woodshed. Just since mid-October, Tilray (NASDAQ:TLRY), Canopy Growth (NYSE:CGC), and Aurora Cannabis(NYSE:ACB) are down roughly 30% to 50%:

TLRY DATA BY YCHARTS.

There are several reasons cannabis companies have seen their shares hit so hard. For one thing, marijuana stocks had seen huge gains coming into the rollout of recreational cannabis in Canada, with Tilray shares having soared sevenfold, and both Canopy and Aurora doubling in the two and a half months leading up to the rollout. Even with the massive declines that these and other stocks in the sector have suffered since then, shareholders in these stocks have been ahead since the beginning of August.

In addition, a broad-based market correction led to many investors selling off their riskier positions. Just as marijuana stocks benefited from a willingness among market participants to take greater risk in choosing high-growth candidates, the reversal in the stock market’s fortunes led to some suddenly risk-averse investors hedging their bets.

Finally, some marijuana investors simply didn’t realize that it would take time for the efforts of their companies to show up in financial reports. Even though most cannabis companies reported earnings a month after Canada started allowing recreational pot sales, those results were for the quarter that ended in September. Since that was before the rollout, investors will have to wait until next quarter to see exactly how legal cannabis sales affected their businesses.

The marijuana mistake you can’t afford to make

It’s natural to want to respond to fluctuations in share prices. In particular, it’s hard not to react negatively when the stocks you own lose value.

However, when it comes to investing in marijuana stocks, paying too much attention to near-term share-price moves is the biggest mistake you can make.

To understand why, just take a look at the cannabis industry right now. Even the biggest players in the space are still in the early development phase, seeking to grow rapidly by spending huge amounts of capital on expansion plans, to build up production capacity and distribution channels. The markets they’re seeking to serve are only now opening up, and regulations are still relatively tight, making it hard to operate efficiently.

As a result, marijuana stock investors don’t have any real fundamental business results to look at. Share prices are largely based on the prospects for each company to grow into a major player in the space. Even the smallest piece of encouraging news can send shares soaring — and the whiff of even a tiny problem can lead to big plunges in cannabis stocks.

The solution is to understand exactly what your vision is for the cannabis industry, and invest in a way that’s consistent with it. It takes patience to ignore hype and stay focused on that vision, but it’s essential if you want to have any chance of reaping the possible rewards of marijuana investing.

Marijuana is a risky industry for investors, and it’s not for the faint of heart. But if you’re convinced that legal cannabis is here to stay and that legitimate businesses can take full advantage of the opportunity to serve a passionate consumer base, then picking the right marijuana stocks could still pay off in the long run.